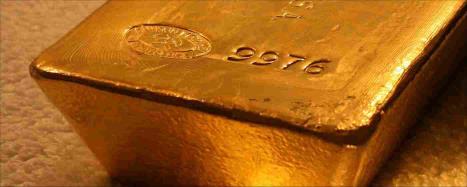

Getting your financial portfolio in order? Investors recommend devoting around 10 to 15% of your portfolio to physical gold, such as gold bullion coins. This is because while the economy becomes unstable, gold retains its value, so you actually see some gains. But besides your personal gain, here are some benefits of investing in gold bullion coins:

-

Gold retains its original value. Even if the price of gold plummets temporally, it sustains its original value. This is because gold is one of the rarest precious metals. Many people desire gold purely for its rarity, making it stay valuable.

-

Gold actually increases in value whenever inflation occurs. In fact, gold is the only currency to remain steady or rise when others like Euros or US dollars begin to fall. In the early 1970s, one ounce of gold equaled $35. If you played the game right, you could either keep the ounce of gold or the cash. But think about the amount of money you’d get if you kept that one ounce of gold, compared to just $35.

-

Owning physical gold is less risky an investment because there is no third-party risk, meaning you aren’t dependant on someone else staying in business or keeping their financial word to you.

-

Gold bullion coins are recognized as legal tender in the country that issued them. Their market value is deciphered by the current value of the fine gold melt content, as well as the premium mark-up among dealers. Certain coins, such as American Gold Eagles or the South African Krugerrands bring the best investment. We’ll now discuss the smartest tips for investing in these coins.

Tips for Investing in Gold Bullion Coins

-

Purchase well-known gold bullion coins that have made investors money for years, such as the American Gold Eagles or the Perth Mint Kangaroos, which are actually .9999 pure fine gold. If you want to pay lower premiums, add some international gold bullion coins like the Austrian 100 Coronas to your portfolio. They’re not as well-known so they don’t cost as much.

-

Buy 1-ounce coins. Most bullion coins are sold in four demoninations—1-ounce, half-ounce, one-quarter once, and one-tenth ounce. However, the price goes up for anything over an ounce.

-

Stick to bullion coins and don’t venture in to collector’s coins or numismatic coins. These coins cost more because they’re based often on their historical value more than their melt value.

-

Work with a dealer that isn’t going to gouge you on coin premiums and spot prices. Buy gold bullion in Brisbane from a dealer who works with you on fair prices, and is willing to buy it back from you if you’re ever in a financial crisis.

Besides the financial gain, there’s something emotionally satisfying about going into a gold dealer and coming out with a few valuable gold coins that you can visibly see and touch, since most of the investments in our portfolio we can’t physically handle.

At the beginning of 2016, gold was valued at £720 an ounce. The US Presidential election made it sky-rocket to around £1078 an ounce, and it has since tapered off to around £1000 an ounce, but it’s still an ideal time to invest now.